There are quite a few macroeconomic releases scheduled for Friday. First, it is important to note the activity indices for January in the UK, Germany, the EU, and the USA. In America, internal ISM indices are considered more important than S&P indices. However, in Europe and Britain, these indices are the only ones available. Therefore, the market will focus on them. In the UK, the retail sales report will also be released, while in the US, the University of Michigan consumer sentiment index will be released. However, we want to remind you that in recent months, the market has not responded well to macroeconomic data, and many reports have been completely ignored.

Several fundamental events are scheduled for today, but the most important events have already taken place this week. Donald Trump, in his characteristic manner, imposed tariffs, then canceled them three days later after the opposing party made concessions. It is still unclear what these concessions were and what NATO Secretary General Mark Rutte and Donald Trump agreed upon, but the tariffs will be canceled starting February 1. At the same time, traders still need to understand the European Union's and Denmark's positions on the agreements related to Greenland. As of now, no one knows what that position is. The data on the U.S. economy's 4.4% growth in the third quarter did not impress anyone, and today's releases may have only a muted impact on market sentiment.

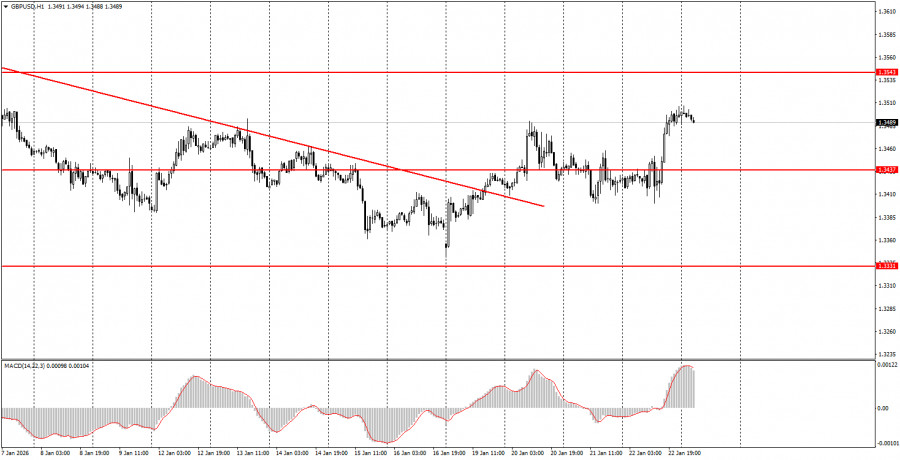

Throughout the last trading day of the week, both currency pairs may resume their upward movement, as the downward trends for both the euro and the pound have been broken this week. The euro can be traded today in the range of 1.1745-1.1754, while the British pound can be traded in the range of 1.3484-1.3489.

Support and resistance price levels — levels that serve as targets when opening buys or sells. Take Profit can be placed near them.

Red lines — channels or trendlines that reflect the current tendency and show which direction is preferable to trade now.

MACD indicator (14,22,3) — histogram and signal line — an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always listed in the news calendar) can strongly affect a currency pair's movement. Therefore, during their release, trading should be done with maximum caution, or positions should be closed, to avoid a sharp price reversal against the preceding move.

Beginner forex traders should remember that not every trade can be profitable. Developing a clear strategy and effective money management are the keys to long-term trading success.

LINKS RÁPIDOS