The US dollar is set for its worst weekly performance since June amid a spike and subsequent fading of geopolitical risks around Greenland. EUR/USD's rally this week shows that, at this stage, uncertainty over White House policy matters more to traders than macro data or central?bank actions.

Weekly performance of the US dollar

After a confident start to 2026, the US dollar came under pressure due to Donald Trump's intent to seize Greenland. To show he was serious, the president announced 10% tariffs on a number of European countries starting February 1. Similar to the "Sell America" episode on Liberation Day in April, the USD index plunged as part of a "Sell All Things American" strategy.

Some dollar strength returned amid the escalation of the geopolitical conflict. A talk with NATO Secretary General Mark Rutte was enough for Trump to back down from his threats. The shift from "sell America" to TACO — "Trump Always Backs Down" — initially supported the US dollar, then sank it. The point is that falling Treasury yields and a rally in equity indices create an unfavorable environment for safe?haven assets.

Rising global risk appetite unleashed EUR/USD buyers. They ignored the upward revision to US GDP for Q3 to 4.4%, the lack of upward pressure in initial jobless claims, and still?elevated inflation as measured by PCE at 2.8%. Those figures allow the Fed to remain paused on easing, which earlier in the year supported the US dollar.

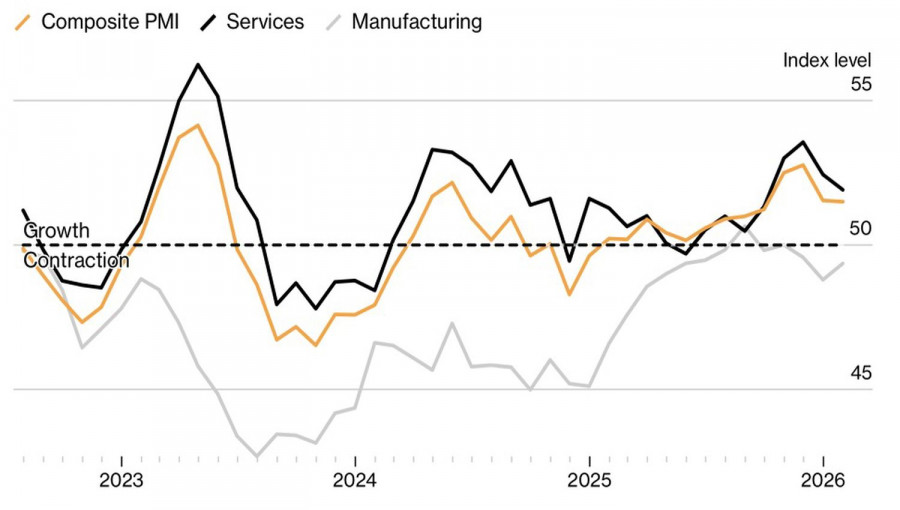

Business?activity dynamics in the eurozone

It's not that eurozone business?activity data handed the euro a helping hand in January. The composite PMI exceeded the critical 50 threshold for the second month running — a sign of expansion — but the actual reading fell short of forecasts. Overall, the indicator portrays the currency?area economy as remarkably resilient to US tariffs, but hardly thriving.

The ECB minutes did nothing to boost EUR/USD. As expected, officials signaled the end of the monetary?expansion cycle but refrained from hinting at deposit?rate increases. On the contrary, doves expressed concern that weak domestic demand could slow inflation, which would argue for lower borrowing costs. There is no sign of a divergence before June, which should support the US dollar.

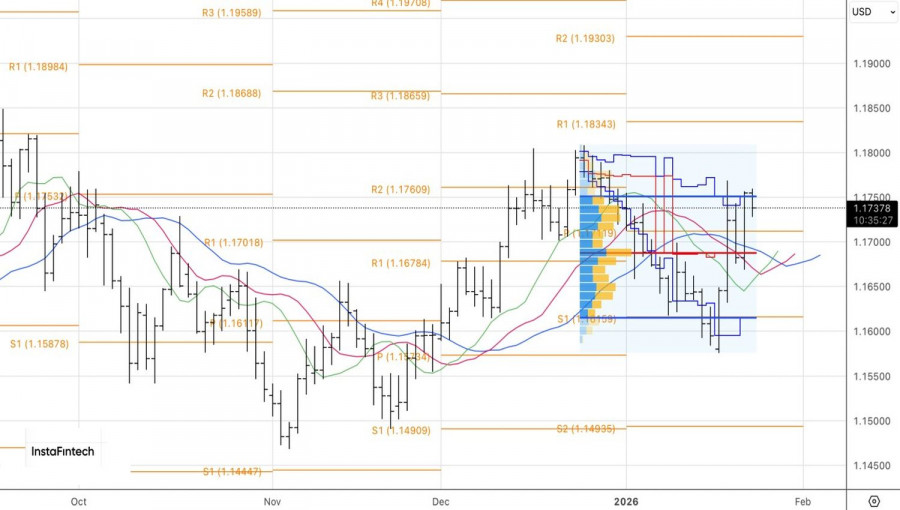

Technically, on the daily EUR/USD chart bulls attempted to push the pair outside its fair?value band of 1.1615–1.1750, but failed. If further assaults also falter, buyers' weakness will give grounds for selling the major currency pair.

SZYBKIE LINKI