Malajsijské ministerstvo obchodu plánuje v červenci pobídky pro domácí polovodičový průmysl, informovala ve středu státní média s odvoláním na ministra obchodu.

Ministr obchodu Tengku Zafrul Aziz uvedl, že v tuto chvíli nemůže poskytnout podrobnosti, ale vláda bude čipový průmysl i nadále podporovat, informovala státní tisková agentura Bernama.

Malajsie je významným hráčem v odvětví polovodičů, na které připadá 13 % celosvětového testování a balení. V posledních letech přilákala investice v řádu miliard dolarů od předních firem, včetně Intel a Infineon.

"To survive, one must adapt." Kazuo Ueda's diplomacy has convinced investors of the potential for a December cut in the overnight rate. According to a Reuters insider in the government, the Bank of Japan will continue its normalization efforts, and the Prime Minister must simply accept this. Just a year ago, Sanae Takichi called tightening monetary policy foolish. Perspectives change, and along with them, the upward trend for USD/JPY is breaking.

One can only speculate how Ueda managed to convince the Prime Minister—perhaps by emphasizing the need to combat inflation or by referencing the weak yen, which does not please the United States. The government will turn a blind eye to the increase of the overnight rate from 0.50% to 0.75%, a level not seen since 1995.

A Bloomberg insider suggests that the BoJ will not only resume its monetary tightening cycle but will also hint at its continuation in the future. This should strengthen the yen and create a barrier against further consumer price growth.

Ueda is doing what he must—preparing markets for an eventual rate hike. He stated that the Board of Governors would discuss this issue and make a decision. Such rhetoric aligns perfectly with what the central bank head said in January before tightening monetary policy. The futures market has raised the probability of this outcome for the December 19 meeting from 58% at the start of winter to 90% now.

Rumors of normalization are already manifesting. Consumers unexpectedly cut spending for the first time in six months. According to the BoJ, a cycle must be observed in which rising wages lead to increased spending by Japanese households, resulting in accelerated inflation. Supply chain issues could slow consumer prices.

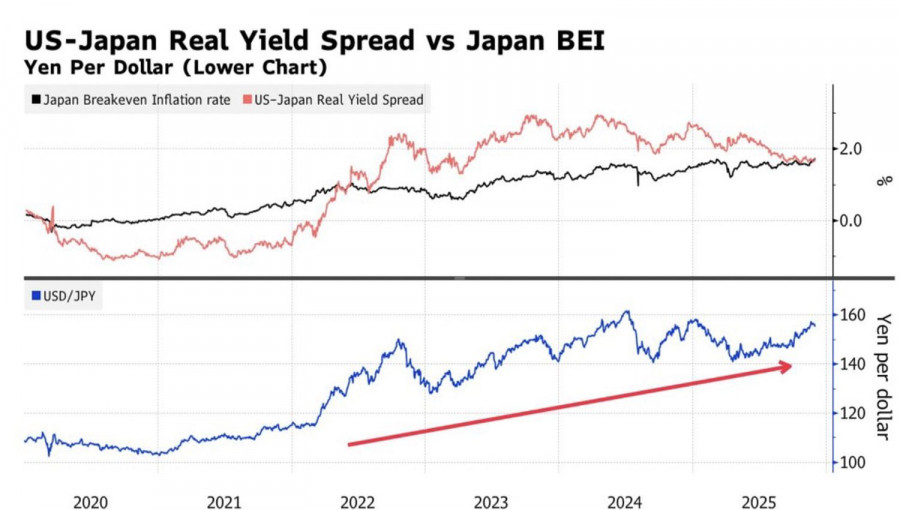

The rise in inflation expectations in Japan has reached its highest levels since 2024. This indicator is highly correlated with both the yield differential between American and local bonds and with USD/JPY.

It is logical that rising expectations for inflation will lead to higher rates in Japan's debt markets, prompting the BoJ to tighten its monetary policy. As a result, the yen strengthens, while inflation expectations wane.

The divergence in the paths of the overnight rate and the federal funds rate allows Reuters experts to consider the yen the primary favorite for 2026. A similar situation occurred at the end of 2024; however, the BoJ's sluggishness displeased the yen, causing it to weaken for much of the current year.

Technically, the daily chart for USD/JPY continues the implementation of the reversal pattern "Three Indians." This pattern increases the risks of a trend break. Short positions s established at 156.8 should be maintained, with targets set at 152.7 and 151.7.

QUICK LINKS